April 2014 • Heartland Real Estate Business www.REBusinessOnline.com

The PENDULUM begins to swing TOWARD LANDLORDS in Omaha’s Industrial Market.

Rental Rates Hold the Key

The biggest reason for the lack of speculative development has been the relatively flat rental rates, which historically have ranged between $4.50 and $5 per square foot across most industrial use subtypes. Landlords often comment that they are renting space for about the same cost per square foot today as they were 20 years ago. Although the market has unquestionably expanded and matured over the years, demand for industrial space has never caused a significant spike in rental rates. However, that is beginning to change. A little more than a year ago, it was not uncommon for landlords to offer multiple months of rent abatement to prospective tenants and a small but significant amount of tenant improvement dollars on lease terms that rarely exceeded 60 months. During the past several months, however, the tide has started to turn. Spaces that had been vacant for a number of months are beginning to see competing letters of intent. Free rent has all but become a thing of the past. Tenant improvement dollars, while still prevalent to a certain degree, have started to decline. Meanwhile, rental rates are starting to rise for what seems like the first time in decades. Although the increase is slight and rates seem to have barely breached $5 per square foot, the trend is finally heading in the right direction.

Tenants On the Move

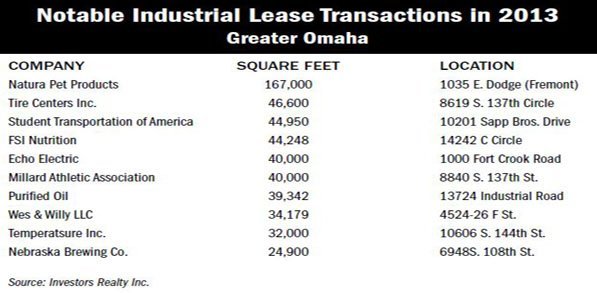

Omaha’s economy is thriving overall, and businesses appear to be in the expansion mode. In the industrial market, in particular, tenant demand for space has been growing during the past few years. In late 2011, Little Snacks Inc., the maker of Jack Link’s Beef Jerky, purchased a vacant 414,000-square-foot warehouse in the Omaha bedroom community of Underwood, Iowa. Meanwhile, Sergeant’s Pet Care Products Inc. has made two significant investments in the Omaha market during the past two years. The company opened a new and expanded Sarpy County headquarters, located at 10077 S. 134th St., approximately two years ago. The 131,110-square-foot facility doubled Sergeant’s previous Omaha office space and added a production operation that before had been in Memphis, according to the Omaha World Herald. Additionally, a $7.2 million distribution center for Sergeant’s Pet Care is under construction near 126th Street and West Giles Road in suburban La Vista, Neb. The 350,000-square-foot facility will replace the company’s existing distribution center in Memphis, Tenn. Up to 60 people will be employed at the office, warehouse and distribution center, according to the Omaha World Herald. The building is slated for occupancy in October. Smaller companies are making large expansions in Omaha, too. Nebraska Brewing Co., for example, recently opened a 24,900-square-foot brewing facility. Most of the brewing operations for the company previously were completed inside its restaurant in the nearby suburb of Papillion. National forklift company MH Equipment expanded its presence in Omaha this year by adding 16,000 square feet to its existing 9,600-squarefoot showroom. As rents rise, the development of new speculative industrial properties and industrial parks will become more prevalent. In short, the future looks quite promising for this sector locally.