This has been a year of stabilization and recovery in the Omaha investment property market. Through October, total transaction volume has reached over $400 million across nearly 100 transactions. Transaction dollar volume was down for the year, due to a few large transactions in 2024 that skewed the results. The number of transactions for 2025 increased 24% to 101.

The Federal Reserve made their second rate cut, and we are seeing interest rates drop, some as low as 6% for the right property. The 10-year treasury rate is roughly unchanged from the 2024 closing rate of 4.04% while lender spreads have tightened.

The National Council of Real Estate Investment Fiduciaries (NCREIF) property index has posted its fourth consecutive quarter of positive returns. Commercial property prices rose in September, with annual gains for major property sectors other than multifamily, according to MSCI Real Assets.

The Takeaway: As financial conditions improve and the market becomes more predictable, it gives investors the confidence to plan and act.

Retail: Steady Activity with a Focus on Shopping Centers

Retail has been the most active sector in 2025, accounting for almost half of the transactions and roughly $131 million in volume YTD. Notable retail transactions for the year include:

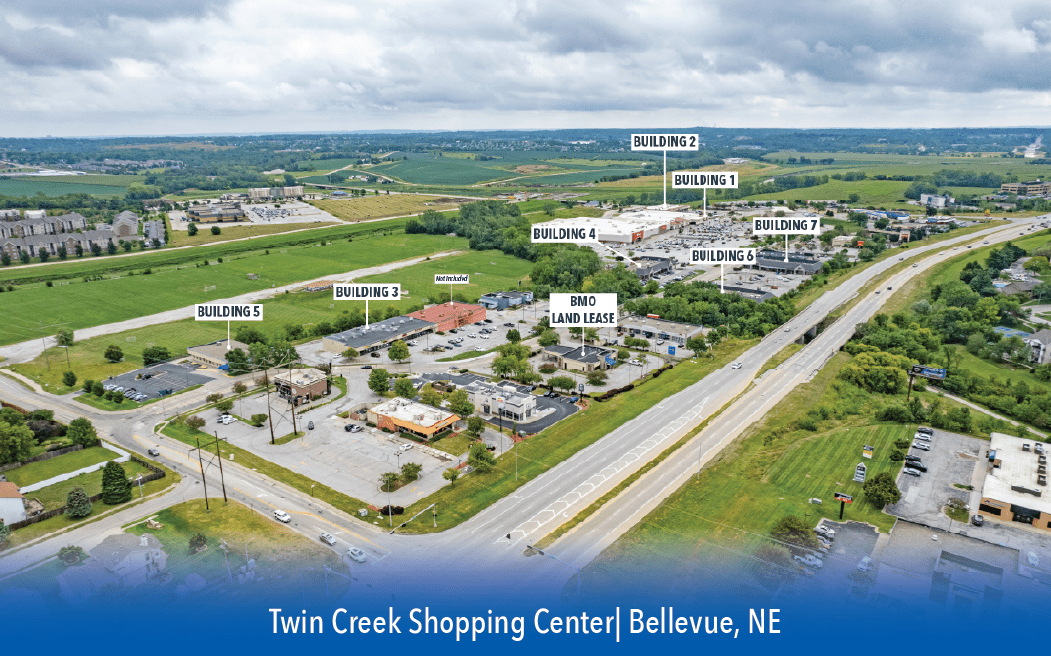

- the Twin Creek shadow-anchored portfolio located in Bellevue for $13.6 million

- the Plaza North grocery anchored center on North 90th Street for $14.5 million, and

- the Midtown Crossing assemblage on Saddle Creek for $9 million

A total of 19 Omaha area shopping centers sold in 2025.

Industrial: Big-Ticket Deals Drive Volume

Industrial property transactions totaled over $100 million across just 13 transactions – about 27% of YTD dollars, despite only 14% of deals. Key highlights include: the River Road Logistics Building 2 for $26 million and the Amazon Distribution facility at 9722 S. 132nd Street for $47.2 million, which was part of a national portfolio purchased by Blackrock.

Office: Selective Recovery with Conversion Plays

Office sales have been more subdued, with 12 transactions totaling approximately $30 million. Most of the sales were in the $2 – $3 million range, with the exception of the Papillion VA hospital for $11.1 million. Medical Office demand remains strong. Buyer demand for traditional office space has been muted, and Sellers are reluctant to sell at today’s prices if they don’t need to.

We expect 2026 to be another strong year with interest rates being flat to slightly down.

This article appeared in our company newsletter in December of 2025. Please click here to download the entire newsletter.