The Omaha Metro area apartment market, like the rest of the United States, remains healthy ten years into the country’s recovery and expansion period.

The Omaha Metro area apartment market, like the rest of the United States, remains healthy ten years into the country’s recovery and expansion period.

Looking at CoStar’s current occupancy rate, Omaha is still 95.2% occupied despite a steady and strong amount of supply entering the inventory. According to the Omaha Chamber of Commerce, from 2012 through 2018, there was an average of 1,500 new permits for individual units pulled per year. Currently, there are nearly 3,500 units under construction, which will come on line in 2019 and 2020. Despite a climate of elevated construction, net absorption exceeds new supply, which has resulted in favorable rent growth and lower vacancy.

Nationally, the trend is similar. According to Jeanette Rice, head of Multifamily Research at CBRE, 2018 completions were slightly under 2017’s high water mark of 277,000 units, which appears to be the cycle peak. Coincidentally, Omaha peaked in 2017 with 2,116 permits pulled. While there has been a shift to urban living, currently 60% of multifamily construction is happening in the suburbs.

Multifamily Values

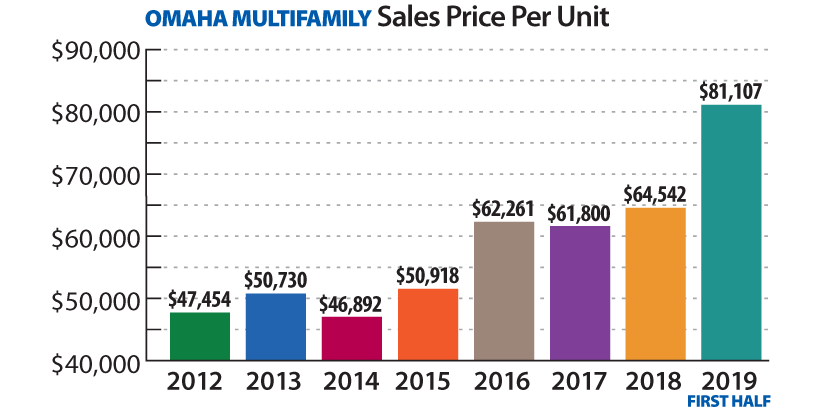

Values continue to rise as capitalization rates remain low. Looking at the data for the first half of 2019, the average sale price per unit reached $81,100, which is up considerably compared to 2016 through 2018 when the average price per unit sold was between $60,000 and $65,000 for each of those three years. The first half of 2019 was impacted by four large sales. Lakeside Hills, a 201-unit senior living community at 17040 Frances Street, sold for $27,500,000 or $136,816 per unit. Oakwood Trail, a 128-unit development near 120th and Fort, sold for $12,600,000, just below $100,000 per unit. Two smaller projects that were built within the last 10 years also contributed to the higher trend. Ekard Court, a 36-unit building located in Midtown and now rebranded as The Helen brought in $125,000 per unit, and a 12-unit townhome project on the backside of a strip center near 144th and Fort sold for $150,000 per unit.

While prices are up locally, the national trend mirrors Omaha. Nationally, CoStar reports the average sale price per unit in 2014 was roughly $100,000 while today’s average sale price is nearly $160,000.

Supply and Demand

If you drive around Omaha, you will notice a significant amount of multifamily construction. The 3,500 units that are currently under construction across the city will transition into deliveries and may create some upward pressure on the vacancy rate in the short term. However, the demand side of the equation remains strong due to several factors. Lifestyle trends such as postponing marriage and children have led to delayed home purchases. Flexible living and little desire to be tied to a mortgage have also added to the pool of renters. However, economics may be the biggest culprit of the robust demand. With very little supply of starter homes for sale, increased home values and higher construction costs, the affordability crisis of housing is prevalent whether one buys or rents. A study by the Urban Institute revealed that with more than $1.6 trillion of student debt, the home ownership rate is only 37% for 25 to 34-year-olds, which is 8% lower than Gen Xers and Baby Boomers at the same age. There would be 3.4 million more homeowners today if the home ownership rate had stayed consistent with previous generations.

According to CoStar, nationally and locally, the vacancy rate has decreased over the past year which has reversed an upward rising vacancy trend during 2016 and 2017. Low vacancy and new construction product have pushed Omaha metro rents higher at an annual growth rate of 2.3%.

Sales Volume and Outlook

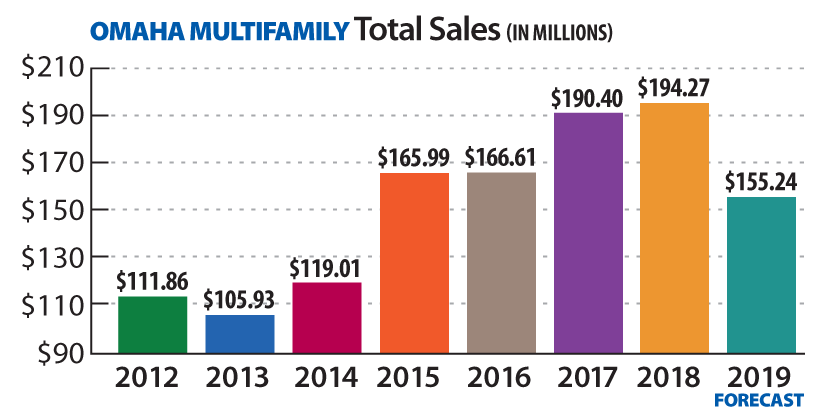

2017 and 2018 were huge years for total multifamily transaction sales, and it is directly attributed to healthy fundamentals for the sector. Omaha continues to see REITS, private equity groups, family offices and individuals from larger markets looking to purchase in Omaha. Most marketed deals have a myriad of offers and the winning buyer usually has a strong motivation to purchase a property whether it is driven by a 1031 exchange, being tired of sitting on the sidelines, or a neighbor seeing efficiency by bolting on an adjacent property. While Omaha is down this year for total transaction volume, demand remains strong from buyers. Barring an economic downturn, the forecast for a strong finish to 2019 remains favorable.

This article appeared in our company newsletter in September of 2019. Please click here to download the entire newsletter.