2023: A CHALLENGING YEAR FOR THE INVESTMENT PROPERTY MARKET

A perfect storm of sharply rising interest rates, high inflation and recession fears has prompted a substantial slowdown in the investment property market. Investment property sales volume in the Omaha area is down 56% from 2022.

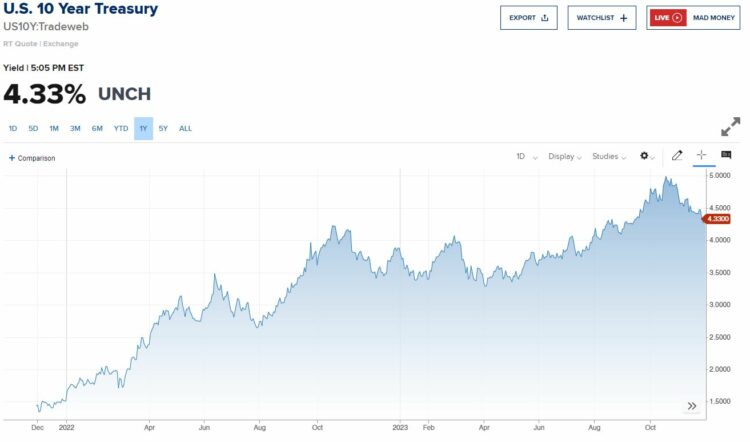

The most significant driver of the slowdown was the cost of debt. Borrowing costs went from the low 3% to the mid 7% range. The yield on the benchmark 10-Year Treasury rate (which many commercial loans are based on) has tripled in the past two years. The 10-Year Treasury has gone up 1% to approximately 5% in the past 30 days. All this has caused a substantial drop in mortgage volume, which is expected to drop 46% in 2023.

Excluding multi-family, most investment transactions in 2023 were single-tenant properties in the sub $3 million price range. We did not see the larger retail, office or industrial sales we would see in a typical year. Notable transactions for the year included the sale of Millard Plaza for $8 million, the sale of 8420 West Dodge Road for $6,250,000, the sale of the Children’s Physicians clinic at 200th & West Maple Road for $5.8 million, and the liquidation of multiple properties from the Jerry Gordman Estate.

The question on everyone’s mind is how pricing has been affected by all of these changes. We have multiple comparables in the single-tenant net-leased category sub $3 million – those cap rates are approximately 50 to 75 basis points higher. Those properties are often purchased with little or no debt, which lessens the impact of higher interest rates. For the remaining sectors, it is hard to quantify current pricing because we don’t have a lot of comparables to look at. Cap rates for the Gordman’s estate properties were approximately 75 basis points higher than the market peak in 2021.

Compared to other markets, Omaha has held up well and property fundamentals are still good. Even the beleaguered office segment has held up well in the Omaha area – surprisingly, many of the trades over $3 million were in the office sector.

Once interest rates stabilize, I would expect to return to a more normal market. Market participants are ready to get back to work, and there will be substantial capital available once conditions normalize.

This article appeared in our company newsletter in December of 2023. Please click here to download the entire newsletter.