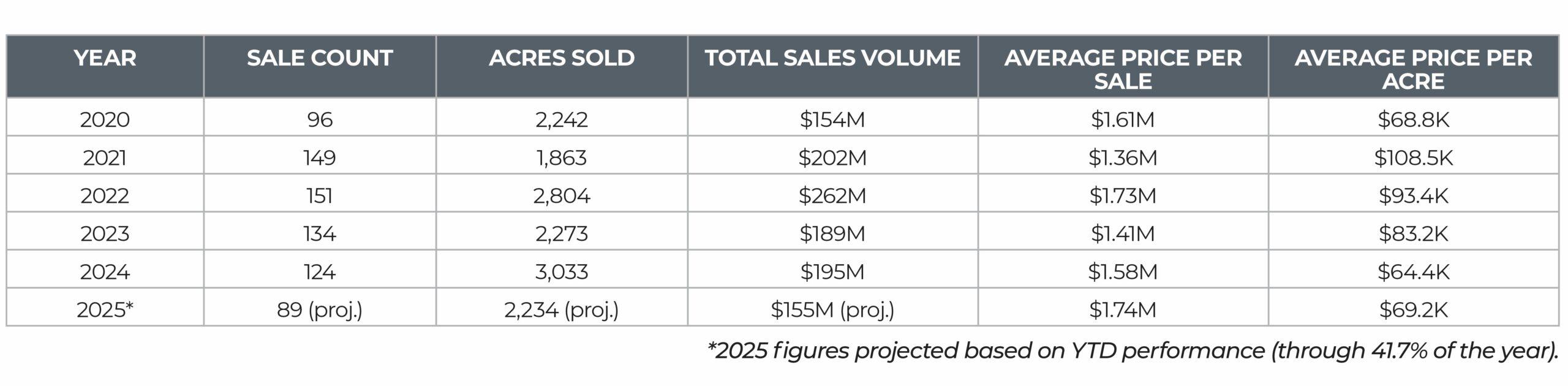

In the past five years, Omaha’s commercial and development land market has seen notable shifts in pricing, volume, and sales velocity. As we look at 2025 projections based on year-to-date data, some patterns are emerging, both in terms of opportunity and caution.

SALES VOLUME & PRICE TRENDS (2020-2025 PROJECTED)

Key Insights

- Stabilizing Prices: While average sale prices dipped in 2021–2023, they have rebounded sharply in 2025 YTD, matching 2022 levels.

- Acreage & Volume Shift: Total acres sold peaked in 2024, likely due to larger tracts changing hands. In 2025, fewer acres and deals are expected, but with higher price points.

- Fewer Deals, Bigger Dollars: Despite a projected 28% decrease in sale count from 2022, the average deal size has reached a five-year high, indicating selective but high-value transactions.

Macroeconomic Drivers

Several national and global factors are shaping Omaha’s land market:

- Interest Rates: The Federal Reserve’s rate hikes since 2022 have raised borrowing costs, cooling speculative land buying and compressing margins for developers using leverage. The recent hold on rate increases may encourage more activity later in 2025.

- Inflation & Construction Costs: High material and labor costs have pushed developers to be more cautious with land acquisition, waiting for stabilization in build costs.

- Tariffs & Supply Chain: Import-related tariffs, particularly on construction materials and equipment, have squeezed project feasibility, especially for new developments.

Outlook for 2025

The first five months of 2025 show that even with fewer transactions, confidence remains strong among well-capitalized buyers. If interest rates hold or decline, we could see a stronger back half of the year. Conversely, macro uncertainty or further cost increases could temper activity. The second half of 2025 will be interesting to see if land sales stay projected at the lowest number of sales since 2020 or if they will increase and users/investors can justify the higher borrowing costs.

This article appeared in our company newsletter in June of 2025. Please click here to download the entire newsletter.