Omaha’s office market HAS STABILITY

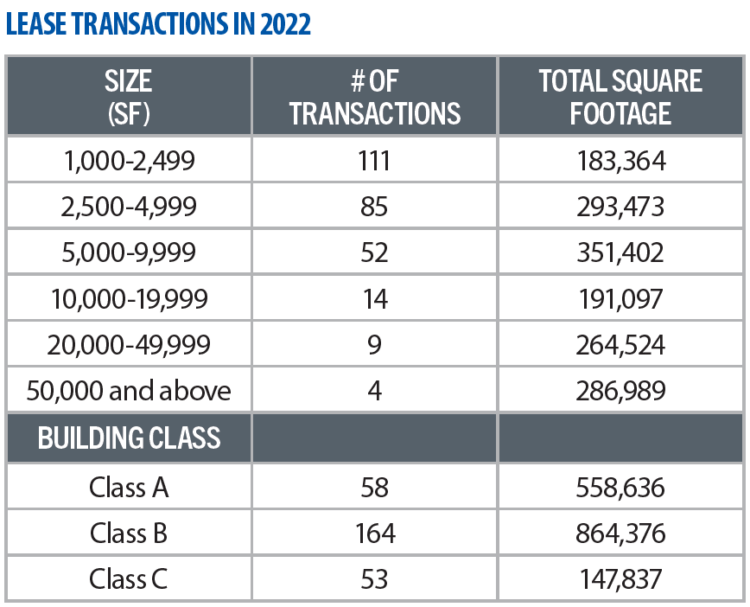

Omaha’s Office Market is performing better than many other metropolitan areas. Omaha saw a reduction in vacancy, reasonable absorption and a healthy number of transactions in 2022. One area of concern is the presence of more sublease space than ever before. Office sales were brisk in the first half of 2022 but decreased sharply in the second half, mostly as a result of the increase in interest rates. Leasing activity was stable and picked up in the later part of 2022 as sales decreased. This report includes a list of the more notable lease and sale transactions.

The relatively stable market is due to several factors. First, it seems Omaha based companies tend to want their employees working in the office, although most offer some hybrid solution. Secondly, there is a continuing flight to quality as employers try to entice employees back to the office. We’re seeing some office users decrease their footprint in conjunction with increasing the quality of their space. Also, the conservative nature of the development community kept new construction at appropriate levels prior to the pandemic.

The relatively stable market is due to several factors. First, it seems Omaha based companies tend to want their employees working in the office, although most offer some hybrid solution. Secondly, there is a continuing flight to quality as employers try to entice employees back to the office. We’re seeing some office users decrease their footprint in conjunction with increasing the quality of their space. Also, the conservative nature of the development community kept new construction at appropriate levels prior to the pandemic.

2022 saw effectively no new construction starts, which has been the case as a result of the pandemic, but new Class A space of any significant size is becoming almost impossible to find as steady leasing has used up the inventory. Second generation Class A space has also leased well, while a few developers are beginning to sound serious about new office construction.

The large amount of sublease space offers opportunities for businesses as they often come with a rent subsidy from the sublessor and furniture in place. Subleases can be more complicated, and all sublease space is not equal, but the sublease space is providing potential solutions for businesses who want to get their teams back together.

Omaha’s office market is not out of the woods but has several stable components. We are tracking 62 office tenants in the market for 912,000 square feet and think 2023 will see similar leasing to 2022 but fewer sales. We are generally optimistic about Omaha’s Office Market’s future but uncertainty remains and only time will provide answers. Businesses are still adapting to the new normal in the office environment and it remains to be seen how today’s office decisions will fare. Companies who have downsized may wish they had more space and companies which didn’t downsize their footprint may wish they had.

The relatively stable market is due to several factors. First, it seems Omaha based companies tend to want their employees working in the office, although most offer some hybrid solution. Secondly, there is a continuing flight to quality as employers try to entice employees back to the office. We’re seeing some office users decrease their footprint in conjunction with increasing the quality of their space. Also, the conservative nature of the development community kept new construction at appropriate levels prior to the pandemic.

2022 saw effectively no new construction starts, which has been the case as a result of the pandemic, but new Class A space of any significant size is becoming almost impossible to find as steady leasing has used up the inventory. Second generation Class A space has also leased well, while a few developers are beginning to sound serious about new office construction.

To view the full Omaha Year-End Office Report, please click here.

These done deals appeared in our company newsletter in March of 2023. Please click here to download the entire newsletter.