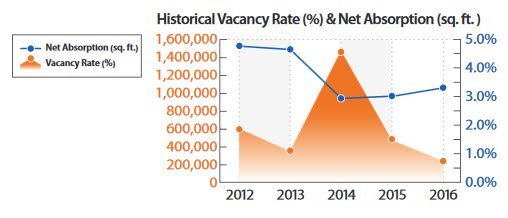

Once again, the Omaha industrial market ended the year with an eyebrow-raising low vacancy rate of 3.2 percent according to data collected by Xceligent. There is no question that it has been a great few years for the Omaha industrial market. In fact, it has been 13 quarters since the local industrial market has posted a vacancy rate higher than 5 percent. That is astounding considering the market has seen over 1.3 million square feet of new construction since 2015.

What is interesting is that 2016 did not involve many large lease transactions, nor did the vacancy rate change that much. The year started with a 3 percent vacancy rate and ende

This construction is showing no signs of slowing down either. Over the past 12 months, a number of large parcels have transacted for future industrial sites and business parks. Sarpy County will continue to expand its industrial market as these new projects come online. Currently, the IRI Industrial Team is tracking 17 projects breaking ground or currently under construction in 2017 that will add close to one million square feet to the overall market.

Industrial expansion is not just an Omaha trend either. Nationally, the e-commerce market and a moderate recovery in US manufacturing has been driving this expansion. Omaha’s growth has mostly come in the form of locally-owned manufacturing, distribution operation and service contractors. Look for the smaller footprint distribution centers to expand in Omaha in 2017 and beyond, as well as the continued growth of local service contractors.

By Kevin Stratman

This article appeared in our quarterly newsletter from March of 2017. The full newsletter is available at http://files.investorsomaha.com/download/IR_newsletter_March_2017.pdf