Omaha’s office market outperformed other metropolitan areas in 2023, continuing the upward trend since 2020. However, it has not maintained the positive trends seen in 2022.

Although the vacancy rate and sublease space in the market performed better than in 2022, the positive absorption, total number of lease transactions, and overall square footage leased did not meet the same levels as in 2022.

2023 Summary

- Leasing transactions continue to outpace sales in 2023.

- Office buildings being sold as investments sell at a higher cap rate than in 2021 and the first half of 2022, due to today’s higher interest rates.

- In 2023, things were more stable than in 2022, but the Omaha office market didn’t bounce back to its pre-pandemic levels. The economy performed reasonably well, but substantial growth is curbed by inflation.

- Office buildings being sold to an owner/occupier are selling at a higher price per square foot due the higher cost of new construction.

Themes From 2023 Expected to Continue in 2024

- Employers want their employees back in the office at least three days a week, and they are receiving notable pushback from employees.

- Businesses are decreasing their office footprints and upgrading the quality of their space to attract employees back to the office.

- New construction starts are well behind previous years, due to increased construction costs and higher interest rates, even though new class A office buildings have low

vacancy rates. - Future new construction starts will lag until construction prices and/or interest rates decrease.

- The lack of new construction will benefit older class A and class B office properties.

- Sublease space is still a pain point for landlords with vacant space as the sublease terms are difficult competition.

- Ghost space remains prevalent in the market, with at least two significant properties in Omaha being quietly marketed for sale, but their availability is not reflected in the office statistics.

- Medical staffing companies, which have lessened the blow to Omaha’s office market, have seen decreasing profits since the end of the pandemic, and they are not growing at their previous pace, forcing some to put their spaces on the market for sublease.

We are hopeful that employees will return to the office and that Omaha’s office market will improve. However, uncertainties remain, and adjusting to the changing office environment may take longer than anticipated.

Investor’s Realty, Inc. is tracking 163 office tenants in the market for 2.1 Million square feet.

Vacancy

The Omaha office market vacancy rate continued its downward trajectory, reaching 7.0% by the end of 2023, a notable improvement from the 7.7% recorded at the close of 2022.

Over the past two years, vacancy rates have consistently trended downward, marking a positive shift after an initial increase in the vacancy rate following the pandemic. While the current rate hasn’t yet returned to the pre-pandemic level of 5.4%,the ongoing decrease in numbers gives a strong reason to be optimistic about the future of the Omaha office market.

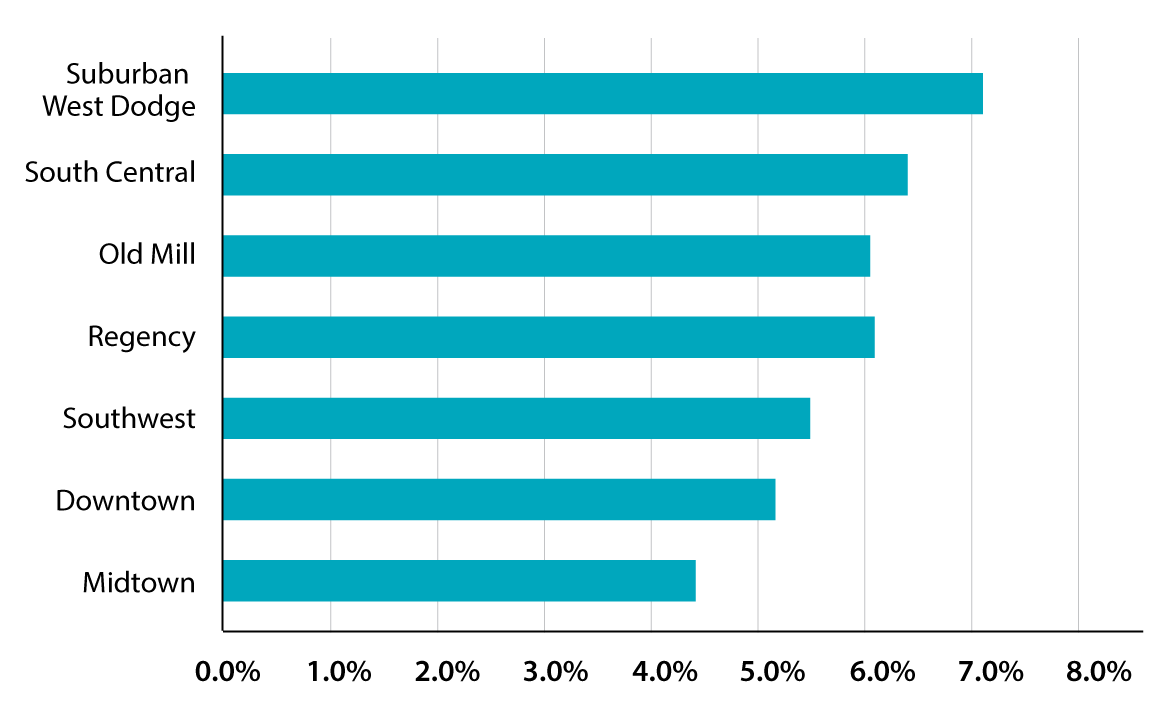

In parallel to the conclusion of 2022, seven out of the twelve submarkets now register vacancy rates either equal to or below the overall office market vacancy rate of 7.0%

OFFICE VACANCY RATES BY SUBMARKET:

Notably, the resurgence observed in the Suburban West Dodge submarket, currently at a 7.0% vacancy rate, serves as a promising indicator for the broader market’s trajectory in the years ahead. In the last quarter of 2021, the vacancy rate in this specific market was 10.2%. This high rate was mainly because the first-generation spaces along the West Dodge corridor required comprehensive full build outs. This made it difficult for deals to be finalized because the costs to renovate the spaces were very high and tenants had to pay out of pocket.

The turning point came in 2023 when tenants embraced longer-term leases, and landlords, in turn, became more accommodating with tenant improvement concessions. This decreased the out-of-pocket costs for tenants. This positive trend is anticipated to continue in 2024 and beyond.

The remaining five submarkets all reported vacancy rates exceeding 7.0%.

To view the full Omaha Year-End Office Report, please click here.

This article appeared in our company newsletter in March of 2024. Please click here to download the entire newsletter.