As we continue to learn more about the impact of the COVID-19 pandemic on different industries, Investors Realty finds itself in a unique position to report on some of the broad effects of COVID-19 on the local real estate market.

We found that businesses were affected differently depending on the type of operation. Most office and industrial types of businesses managed to maintain operations throughout the pandemic by making adjustments to allow for flexible work from home solutions and adopting suggested and required health protocols such as distancing, increased cleaning, and modifications to their air circulation and filtration systems. Retail and service businesses were much more seriously impacted. Some closed permanently and others made adjustments for distancing, deliveries, sanitation and other solutions to keep the operation viable until the pandemic passes.

We sent a short survey to our tenants in our managed-building portfolio and the results are displayed below.

SURVEY RESULTS

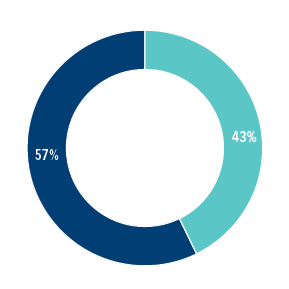

Did your business close for any period of time as a result of the pandemic?

|

|

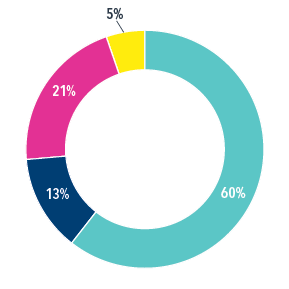

How did the pandemic affect business volume?

|

|

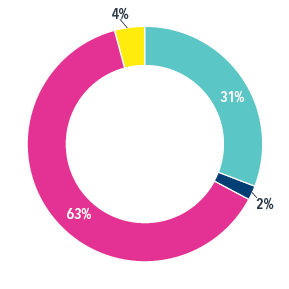

How did the pandemic affect staffing levels?

|

|

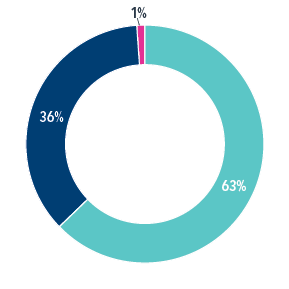

Do you expect expenses to increase in 2021 as a result of the pandemic?

|

|

RENT RELIEF

As you can see, 60% of respondents reported a decrease in business volume due to the pandemic. This unexpected and, for some, significant loss meant that some commercial tenants had difficulty paying their rent. This had a domino effect on landlords, some of whom had to negotiate terms with their lenders or put off repairs.

Investors Realty manages 188 buildings with approximately 1,500 tenants. Our portfolio is divided almost equally among office, retail and industrial/flex properties. In 2020, we had the unique and unprecedented responsibility to navigate through the worst of our clients’ pandemic-related struggles. Part of that responsibility was to understand COVID-19’s effects on many of our tenants as well as our landlord clients, and to help negotiate rent relief in many circumstances. Each situation was unique, and many solutions were considered and implemented. Some situations justified complete rent forgiveness, while other parties agreed that deferral was a more appropriate tool. Some leases were extended to make the landlord whole, while other landlords collected the deferred rent in later months. In total, our property managers helped negotiate 152 agreements between landlords and tenants, 100% of which were made for retail or service industry tenants who were hit the hardest.

BRIGHTER DAYS AHEAD

The good news after nearly a year and a half of dealing with this crisis is that most businesses in Nebraska are on their way back to nearly normal operations. While there were some restaurant and other service businesses that went out of business, leasing in strip retail and service buildings through the second quarter of 2021 is quite active. And we remain hopeful that some of those business owners who had to close can re-open or create new businesses.

We will continue to update you as we learn even more about the short and long-term impact of COVID-19 on the local market. If you need assistance, please contact us.

This article appeared in our company newsletter in June of 2021. Please click here to download the entire newsletter.